The Participation Dividend of Taxation in DRC and Beyond: Recent Evidence and Paths for Future Inquiry – ICTD

2021 Resource Governance Index: Democratic Republic of Congo (Mining) | Natural Resource Governance Institute

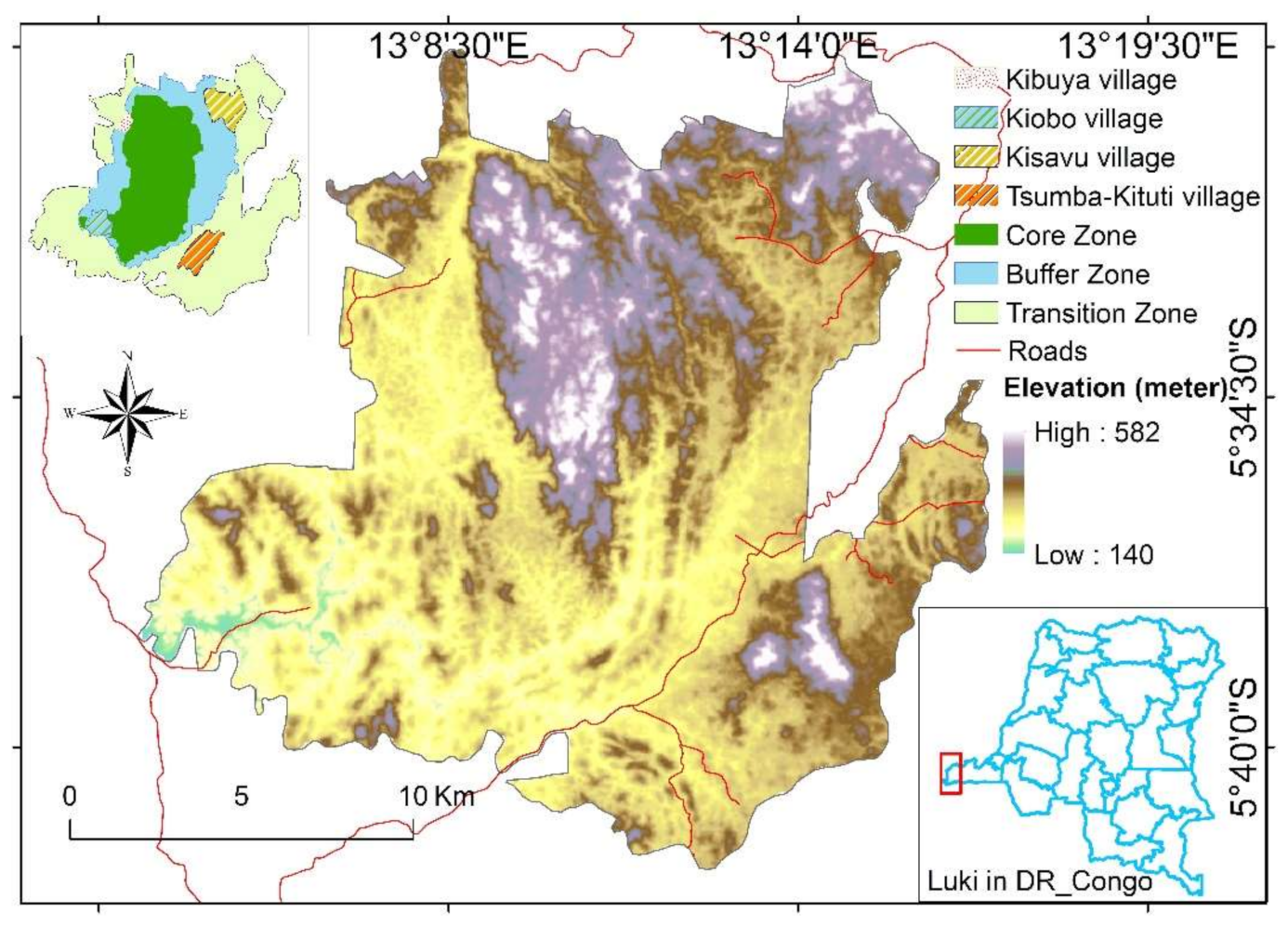

Sustainability | Free Full-Text | Examining Land Use/Land Cover Change and Its Prediction Based on a Multilayer Perceptron Markov Approach in the Luki Biosphere Reserve, Democratic Republic of Congo

The Indigenous World 2022: Democratic Republic of the Congo (DRC) - IWGIA - International Work Group for Indigenous Affairs

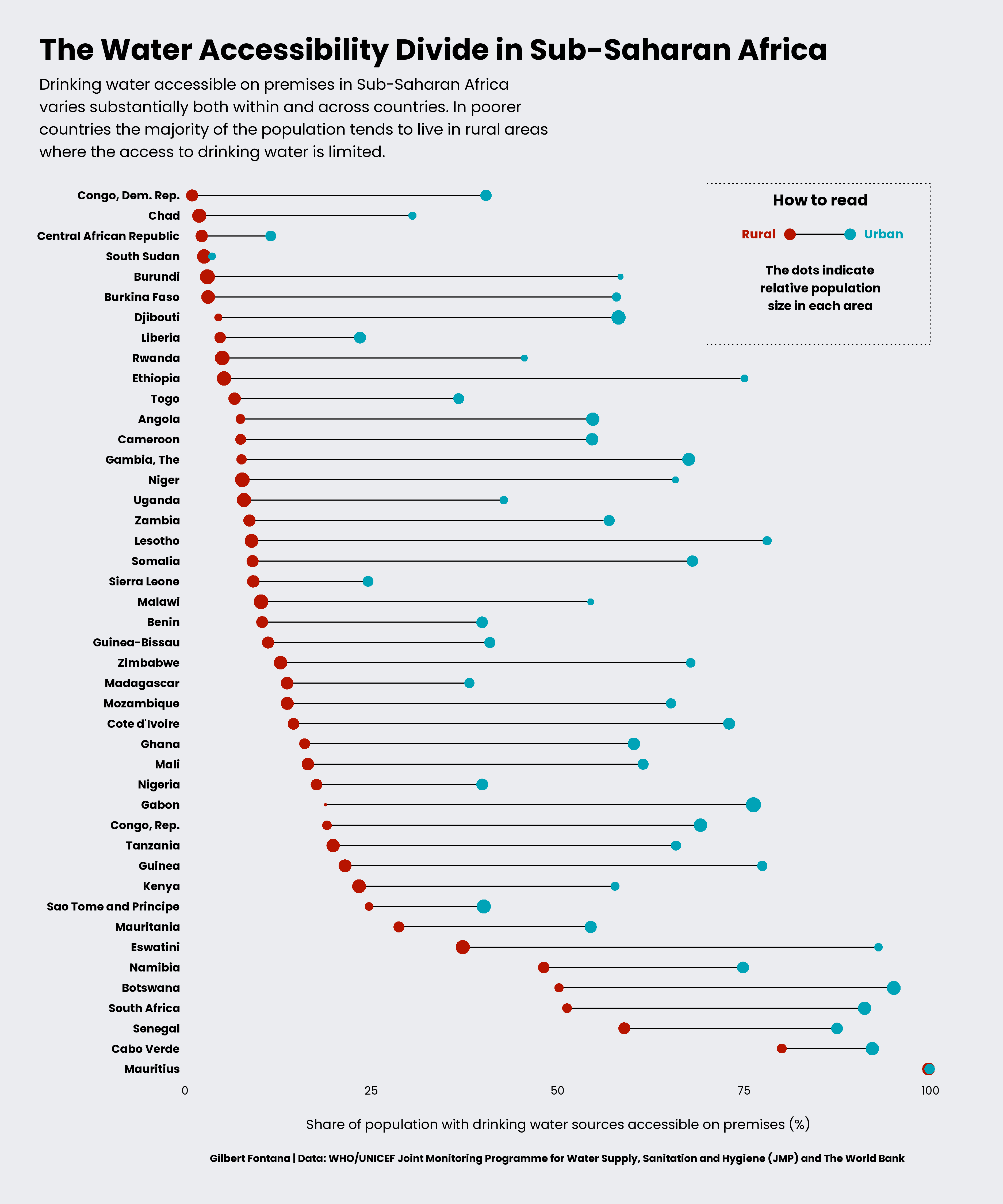

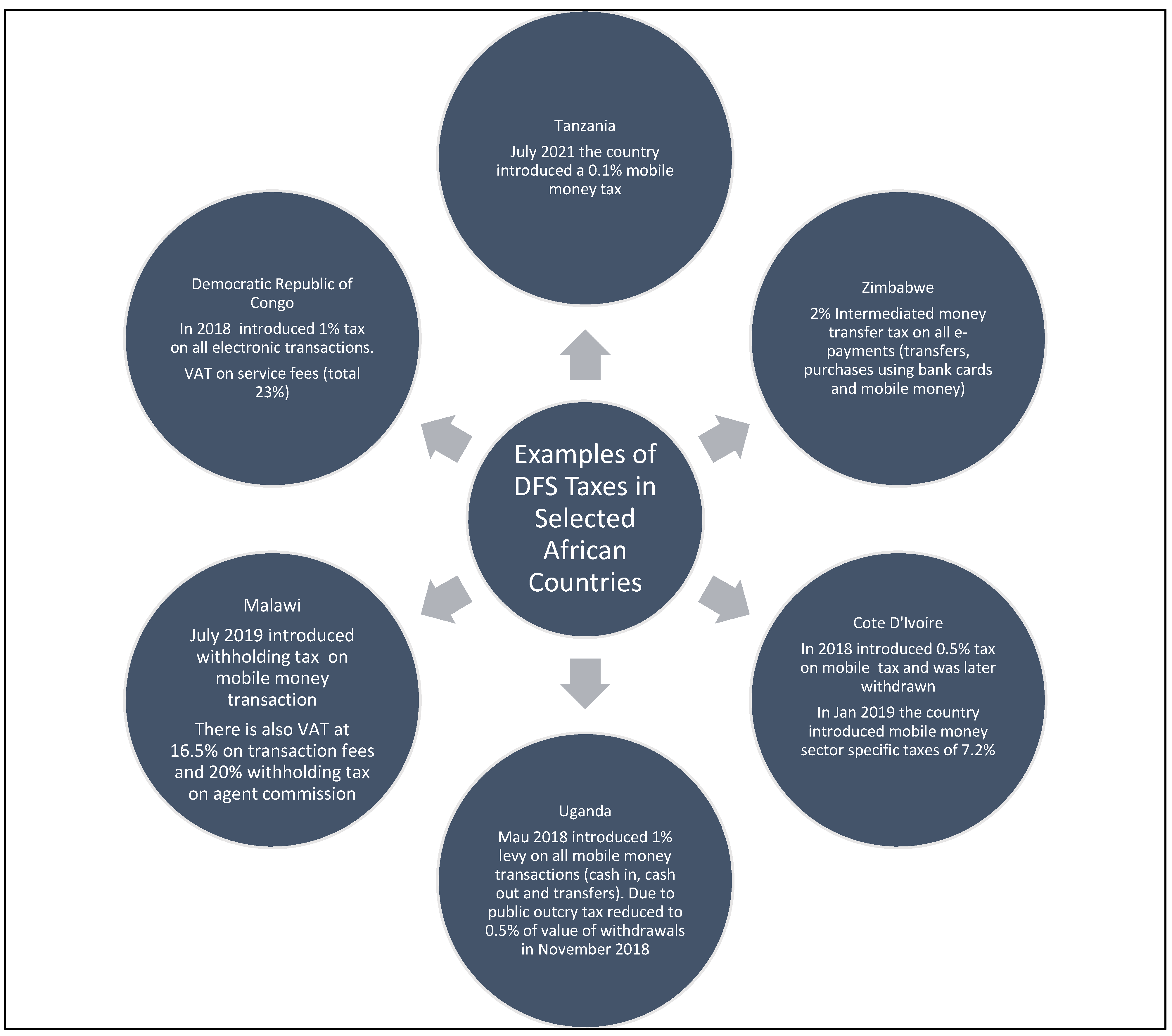

Economies | Free Full-Text | Digital Financial Inclusion, Digital Financial Services Tax and Financial Inclusion in the Fourth Industrial Revolution Era in Africa

Protected areas: a pathway to sustainable growth in the Democratic Republic of Congo | Projects | WWF

Adam Tooze on Twitter: "African tax gap: @IMFNews models “tax capacity” using variables such as GDP/capita, trade openness & governance -> thinks that African governments could increase revenues by 3-5% GDP =